When it comes to connecting to the internet, most Americans rely on a familiar companion – cable internet. It's the go-to choice for millions, powering our online lives in ways we might not even realize.

Cable internet isn't just another option in the lineup. It has its distinct characteristics and advantages that make it stand out from the crowd. Unlike some other internet connections, cable internet uses a combination of coaxial cables, often the same ones used for cable television, to transmit data. This infrastructure allows for the simultaneous transmission of data and television signals, making it a convenient and widely used choice for internet access in many areas.

Understanding what makes cable internet special is essential because it plays a unique role in how we experience the online world. In this analysis, we'll take a closer look at cable internet, delving into its specific features and performance.

Historical Growth and Adoption Rates

Evolution of Cable Internet

Cable internet traces its roots back to the late 1990s when it emerged as a groundbreaking technology. During this time, cable operating companies initiated a significant upgrade of their distribution networks, investing a staggering $65 billion between 1996 and 2002. This upgrade involved the creation of more powerful hybrid networks, combining fiber optic and coaxial cable.

These newly established "broadband" networks could deliver various services over a single connection, including multichannel video, two-way voice communication, high-speed Internet access, and high-definition digital video services.

This network upgrade allowed cable companies to introduce high-speed internet access to customers in the mid-'90s, followed by competitive local telephone and digital cable services later in the decade.

In 1997, a notable development occurred with the release of DOCSIS (Data Over Cable Service Interface Specification) standards by CableLabs. DOCSIS established a standardized framework that enabled cable operators to provide high-speed internet services over their existing cable TV infrastructure.

Historical Growth and Milestone Development

The Cable internet's journey to becoming faster and more reliable has been marked by some significant innovations. At the forefront of these innovations are the Data Over Cable Service Interface Specification (DOCSIS) standards. These standards have played a crucial role in shaping cable internet, enabling it to evolve and improve over the years.

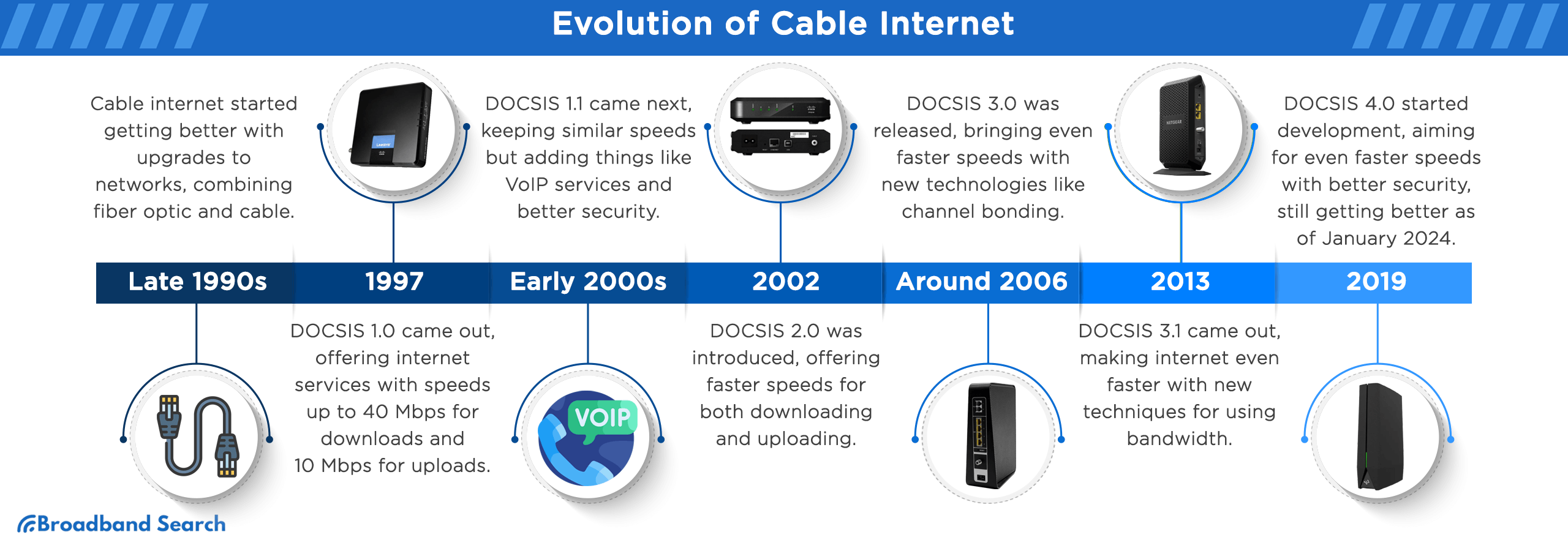

1997 (DOCSIS 1.0)

In March 1997, the DOCSIS 1.0 specification was introduced, bringing typical internet services to cable networks. It operated within specific frequency ranges: 91 to 857 MHz for downstream and 5 to 42 MHz for upstream data transmission. DOCSIS 1.0 provided speeds of up to 40 Mbps downstream and 10 Mbps upstream, meeting global usage demands at the time.

This protocol allowed the transfer of Internet Protocol (IP) traffic through cable TV networks, offering significantly faster data rates compared to analog modems and integrated services digital network (ISDN) connections. Initially supporting a single channel, as competition from DSL and other broadband technologies increased, there arose a need for a new standard to deliver higher speeds to a larger user base.

Early 2000s (DOCSIS 1.1)

Within two years of DOCSIS 1.0, an upgrade to version 1.1 was introduced, maintaining the same data rates of 40 Mbps downstream and 10 Mbps upstream. DOCSIS 1.1 brought several enhancements, notably enabling Voice over Internet Protocol (VoIP) services for cable TV subscribers in April 1999. It also introduced extended security requirements, incorporating Data Encryption Standard (DES) 56 data transmission, which involves encryption methods for data security.

One key difference between DOCSIS 10. and 1.1 lies in their identification systems. DOCSIS 1.0 uses Service ID (SID) to identify cable modems and connected devices, while DOCSIS 1.1 employs service flows. Additionally, DOCSIS 1.1 introduced improved MAC framing features, enhanced provisioning and authorization methods, and advanced Baseline Privacy Interface Plus (BPI+) features.

Service flows are the fundamental building blocks of QoS (Quality of Service) provisioning in DOCSIS 1.1. This version allows multiple service flows per cable modem, enabling the separate identification of various types of traffic, such as data, voice, and video, all on the same cable modem.

2002 (DOCSIS 2.0)

In response to the increasing need for greater bandwidth, DOCSIS 2.0 was introduced in 2002. It introduced symmetrical transport capabilities for both downstream and upstream data transmission. DOCSIS 2.0 utilized frequencies ranging from 50 to 864 MHz downstream and 5 to 42 MHz upstream, providing a wider channel spacing of 6.4 MHz in the upstream direction, a significant improvement over the 3.2 MHz spacing in DOCSIS 1.0/1.1. This expansion of the upstream channel, coupled with enhanced modulation schemes, allowed DOCSIS 2.0 to achieve impressive speeds of 40 Mbps for downloads and 30 Mbps for uploads.

DOCSIS 2.0 improved upstream data transfer by using advanced methods like TDMA and S-CDMA to allocate capacity efficiently among users. TDMA (Time Division Multiple Access) assigns specific time slots to each user within a channel, preventing interference. S-CDMA (Synchronous Code Division Multiple Access) enables multiple cable modems to transmit simultaneously in the same time slot.

Additionally, DOCSIS 2.0 enhanced the performance of DOCSIS 1.1, by introducing 256-QAM (Quadrature Amplitude Modulation). This modulation scheme significantly increased maximum downstream data rates, further improving the overall efficiency and speed of cable internet services.

In the past, North American downstream channels operated at speeds of 27 or 38.8 Mbps, while in Europe and Asia, they ran at 38.4 or 51.3 Mbps. However, even at peak capacity, DOCSIS 1.1's upstream channel could only deliver about one-third of the downstream bandwidth. To achieve symmetrical or near-symmetrical service, wider channels and higher modulation orders were required.

DOCSIS 2.0 greatly boosted upstream capacity to 30.72 Mbps using advanced modulation methods like 64 Quadrature Modulation (QAM) and 128 QAM. In 64-QAM, the carrier has 64 states, while 128-QAM uses 128 symbols for digital data representation.

Before DOCSIS 2.0, cable networks faced noise interference issues that affected data quality. Operators used costly methods like installing filters or segmenting the network to combat noise. DOCSIS 2.0 not only boosted data speeds but also enhanced noise reduction techniques.

This improvement was achieved by enhancing the TDMA modulation method, called Advanced-TDMA (ATDMA), and introducing a new method, S-CDMA. Both ATDMA and S-CDMA are supported by cable modems and cable modem termination systems (CMTSs), providing flexibility for operators to choose suitable methods for their channels.

Around 2006 (DOCSIS 3.0)

To address the need for faster speeds, the DOCSIS 3.0 specification was introduced in 2006, offering several key features. This standard was widely deployed across cable networks in North America and Europe and was designed to achieve gigabit-per-second speeds, making it a significant advancement in cable broadband technology. It brought forth innovations such as channel bonding, which combines multiple channels to boost bandwidth capacity.

DOCSIS 3.0 aimed to maximize broadband speed by introducing several key features, including channel bonding, IP multicast, IPv6 support, and AES encryption. It utilized a frequency range from 108 MHz to 1 GHz for downstream and 5 MHz to 85 MHz for upstream transmission.

One standout feature of DOCSIS 3.0 was its ability to combine multiple downstream and upstream channels through channel bonding. This approach significantly increased bandwidth capacity, allowing for impressive speeds of up to 1 Gbps downstream and approximately 200 Mbps upstream. Additionally, DOCSIS 3.0 brought forth support for IPv6, offering a larger address space and enhanced security compared to IPv4.

This generation of DOCSIS technology laid the groundwork for HFC (Hybrid Fiber-Coax) networks and played a crucial role in the evolution of cable internet. It introduced flexibility by allowing ISPs to utilize multiple channels, offering the potential for even higher performance. Despite the emergence of DOCSIS 3.1, which offers advanced capabilities, DOCSIS 3.0 remains relevant for many ISPs and users who don't require gigabit speeds, ensuring a reliable and satisfactory internet experience.

2013 (DOCSIS 3.1)

DOCSIS 3.1 marked a significant advancement for cable broadband, bringing about transformative changes in the services it could offer. This technology introduced key improvements, departing from the previous DOCSIS 3.0 standard.

Firstly, DOCSIS 3.1 introduced advanced modulation techniques, specifically Orthogonal Frequency Division Multiplexing (OFDM) and Orthogonal Frequency Division Multiple Access (OFDMA). These innovations allowed cable providers to efficiently use the available bandwidth by dividing it into smaller subchannels. Each subchannel could employ different modulation methods, optimizing bandwidth utilization and enhancing performance. This adaptability was particularly crucial for maintaining service quality in challenging network conditions.

The introduction of DOCSIS 3.1 in 2013 facilitated the implementation of GigabitEthernet services within existing Hybrid Fiber-Coax (HFC) networks. It accomplished this by integrating OFDM and Forward Error Correction (FEC) mechanisms into the physical layer (PHY). As a result, downstream efficiency increased by 50%, and upstream efficiency improved by 66%, thanks to enhanced modulation techniques (from 1024QAM to 4096QAM).

Moreover, DOCSIS 3.1 not only achieved higher speeds but also introduced power-management features. These features led to reduced energy consumption, addressing latency and jitter issues that could affect service quality. Cable operators seized this technology to provide 1 Gbps cable broadband services to approximately 80% of U.S. households, enabling a broad spectrum of applications.

One key advantage of DOCSIS 3.1 was its ability to use existing coaxial cables, eliminating the need for costly infrastructure upgrades like those required for fiber deployment. This cost-effective approach made it an attractive choice for cable internet providers.

Lastly, many cable internet providers, including Comcast XFINITY, Charter Spectrum, Cox Communications, and Mediacom, rely on DOCSIS 3.1 technology to deliver high-speed services.

2019 (DOCSIS 4.0)

DOCSIS 3.1 spurred the demand for faster and more reliable broadband services, leading to the development of DOCSIS 4.0 and 10G technology. DOCSIS 4.0 expands both downstream and upstream bandwidth, offering speeds of up to 10 Gbps downstream and 7 Gbps upstream. It comes in two versions: Frequency Division Duplex (FDD), which extends upstream and downstream spectrums separately, and Full Duplex DOCSIS (FDX), enabling simultaneous transmission in the same spectrum. FDX requires echo cancellation technology, and DOCSIS 4.0 has undergone revisions since its initial release in August 2019 to meet evolving demands.

DOCSIS 4.0 brings multi-gigabit symmetrical services, utilizing the full cable spectrum for low-latency delivery in the quest for 10G. It also enhances security with features like Transport Layer Security (TLS) encryption and digital certificates. The technology operates in frequencies from 108 to 1794 MHz downstream and 5 to 684 MHz upstream.

Previously, the maximum upstream capacity was 1.5 Gbps, but DOCSIS 4.0 significantly increases it, enabling multi-gigabit symmetrical services to accommodate new technologies. Cable networks, covering over 90% of American households, benefit from DOCSIS 4.0's efficiency improvements without extensive infrastructure upgrades, ensuring cost savings and future-proofing. Moreover, it's backward compatible with previous DOCSIS versions, allowing seamless network upgrades.

Although DOCSIS 4.0 is still in development as of January 2024, its promising features are poised to shape the future of internet connectivity.

Adoption Rates Over the Years

Cable broadband emerged as a faster alternative to ADSL broadband, utilizing cable television wires for internet delivery.

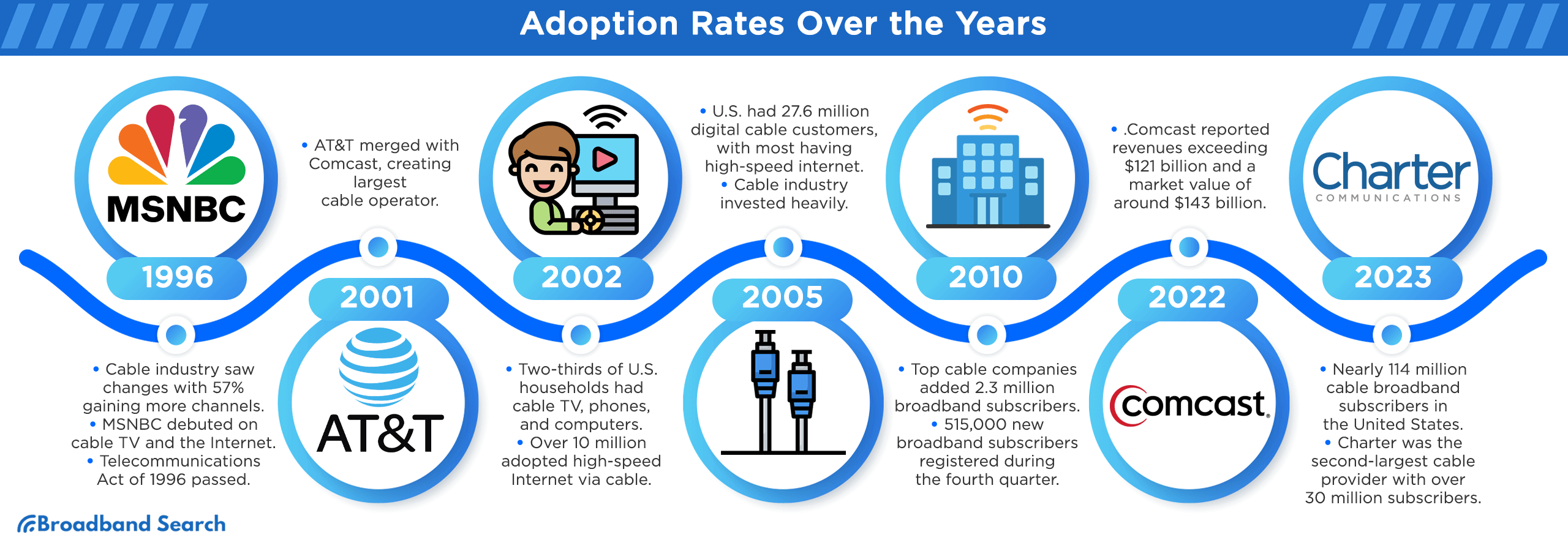

In 1996, significant changes occurred in the cable industry. Approximately 57% of subscribers now had access to at least 54 channels, a notable increase from the previous standard of 47. Cable companies began investing heavily in infrastructure, which marked a significant milestone for the fifty-year-old cable television industry. These upgrades involved laying down fiber optic and coaxial cables, creating what we now know as broadband networks.

These broadband networks paved the way for higher-capacity hybrid networks offering various services, including multi-channel videos, two-way voice communication, high-speed internet access, and advanced digital services. In the same year, MSNBC made its debut on cable TV and the Internet with 22 million subscribers. MSNBC stands for "Microsoft NBC," and it's a channel and website that provides news in the United States.

Additionally, the Telecommunications Act of 1996 was passed, ushering in deregulation and opening up the communications industry to competition. This legislation, crafted by the FCC, led to media mergers and extended First Amendment protections to the Internet.

As the 21st century began, cable companies began pilot-testing innovative video services that could revolutionize television viewing. These services included video on demand (VOD), subscription video on demand (SVOD), and interactive TV.

- Video on Demand (VOD) initially required households to have a high-speed internet connection to access content, unlike traditional broadcast TV

- Subscription Video on Demand (SVOD) demanded substantial infrastructure investment and incurred higher costs for consumers.

- Interactive TV aimed to merge television with online shopping, banking, and other interactive features, taking advantage of TV's vertical format.

Despite the potential, the industry proceeded cautiously due to the expensive equipment upgrades, such as installing fiber optic cables in homes.

In 2001, a significant development occurred as AT&T merged its cable systems with Comcast Corp., creating the largest cable operator ever, serving more than 22 million customers in response to the increasing demand for a better television viewing experience.

During the mid-1990s, the introduction of affordable digital set-top boxes paved the way for new video services. However, delivering advanced services like high-definition television (HDTV) requires more costly technology. HDTV was gradually being offered by cable networks such as HBO, Showtime, Discovery, and ESPN, alongside off-air broadcast stations.

By 2002, around two-thirds of U.S. households had access to three essential communication tools: cable television, cellular phones, and personal computers. Approximately 18% of U.S. homes have adopted digital cable, with an overall digital cable penetration among cable customers of roughly 27 percent. In terms of data services, the research showed that 20% of cable customers with PCs were already using high-speed modems.

Cable operators who had upgraded their two-way infrastructure experienced substantial growth in broadband data services, making cable the preferred technology. It outperformed rival technologies like digital subscriber line (DSL) offered by phone companies by a 2-to-1 margin. By the end of the third quarter in 2002, over 10 million subscribers had embraced high-speed Internet access through cable modems.

In 2005, the United States had over 27.6 million digital cable customers, with 24.3 million of them enjoying high-speed internet access. The cable industry invested heavily, with capital expenditures reaching $100 billion.

Fast-forward to 2010, and cable broadband providers witnessed remarkable growth. Top cable companies alone added 2.3 million broadband subscribers, accounting for 98% of the net additions compared to the previous year. Furthermore, during the fourth quarter of 2010, cable providers registered a substantial 515,000 new broadband subscribers, further fueling the industry's expansion.

According to Statista, the number of subscribers has seen a steady increase in the United States, growing from approximately 73 million in 2011 to nearly 114 million in 2023. Comcast stands out as the most popular cable provider in the US, boasting more than 32 million broadband internet subscribers. Since early 2011, Comcast has held a dominant position, representing over 40 percent of all broadband internet subscriptions in the country.

In 2022, Comcast Corporation reported annual revenues exceeding 121 billion U.S. dollars and held a market value of around 143 billion U.S. dollars. This solidifies its status as one of the largest media companies in the U.S. and a prominent player in the global telecommunications industry.

Following Comcast, Charter claims the position of the second-largest cable provider in the United States, boasting over 30 million subscribers as of 2023. Charter's acquisition of Time Warner Cable and Bright House Networks in 2016 significantly contributed to the company's growth and expansion.

Speed and Performance Data

Average Download and Upload Speeds

When assessing the performance of cable internet, one of the key metrics to consider is the average download and upload speeds. According to recent data, cable broadband connections typically offer the following speed ranges:

- Average Download Speeds: Cable internet provides an average download speed ranging from approximately 10 to 500 Mbps. This level of download speed supports a household of four to simultaneously stream TV shows, movies, and online games on multiple devices while engaging in activities like video conferencing via platforms such as Zoom.

- Average Upload Speeds: For cable internet, the average upload speed falls in the range of about 5 to 50 Mbps. This upload speed is sufficient to support common online activities like smooth video calls and online meetings. It's worth noting that a minimum upload speed of 1-3 Mbps is generally recommended. However, for individuals who frequently upload large files, aiming for an upload speed of 10 Mbps or higher can significantly reduce the time required for file transfers.

Latency Statistics

Cable internet typically has lower latency compared to satellite internet but may have slightly higher latency than fiber-optic internet. On average, cable internet latency ranges from 15 ms to 27 ms.

Latency, or lag, is the delay in data transmission. It's measured in milliseconds (ms) and matters for real-time activities like online gaming and video calls. Cable internet is a good choice for gaming, especially multiplayer and graphics-heavy games, because it offers decent latency, ensuring a smooth experience.

Technological Factors Affecting Speed

Several technological factors contribute to cable internet speed:

- DOCSIS Standards: The evolution of DOCSIS standards has played a pivotal role in improving speed. DOCSIS 3.0, 3.1, and 4.0 have enabled faster download and upload speeds. DOCSIS 4.0, for instance, supports speeds of up to 10 Gbps downstream capacity and up to 6 Gbps upstream capacity, making it a significant milestone in cable internet technology.

- Hardware Upgrades: Early cable modems were basic, allowing only one device to connect at a time. To enable multiple connections within a household, consumers needed separate routers. In time, internet service providers (ISPs) integrated routing capabilities into cable modems. Cable modems are rated with a DOCSIS speed, and these speeds vary among models. Older DOCSIS modem models (e.g., DOCSIS 1, 1.1, and 2) typically offer download speeds of 30-100 Mbps. In contrast, modern models can achieve blazing upload speeds ranging from 1 to 10 gigabits per second (Gbps). This hardware evolution has brought faster internet connections to homes.

- Infrastructure Investments: Cable providers make ongoing investments in their networks to boost speed and capacity. These efforts involve upgrading cable infrastructure, expanding optical fiber networks, and enhancing network nodes. By allocating over $170 billion for infrastructure improvements from 2011 to 2020, cable providers consistently upgraded their broadband networks. These enhancements increased both speed and reliability, ensuring that they could meet the ever-growing demands of consumers.

Speed and Cost Comparisons with Other Internet Technologies

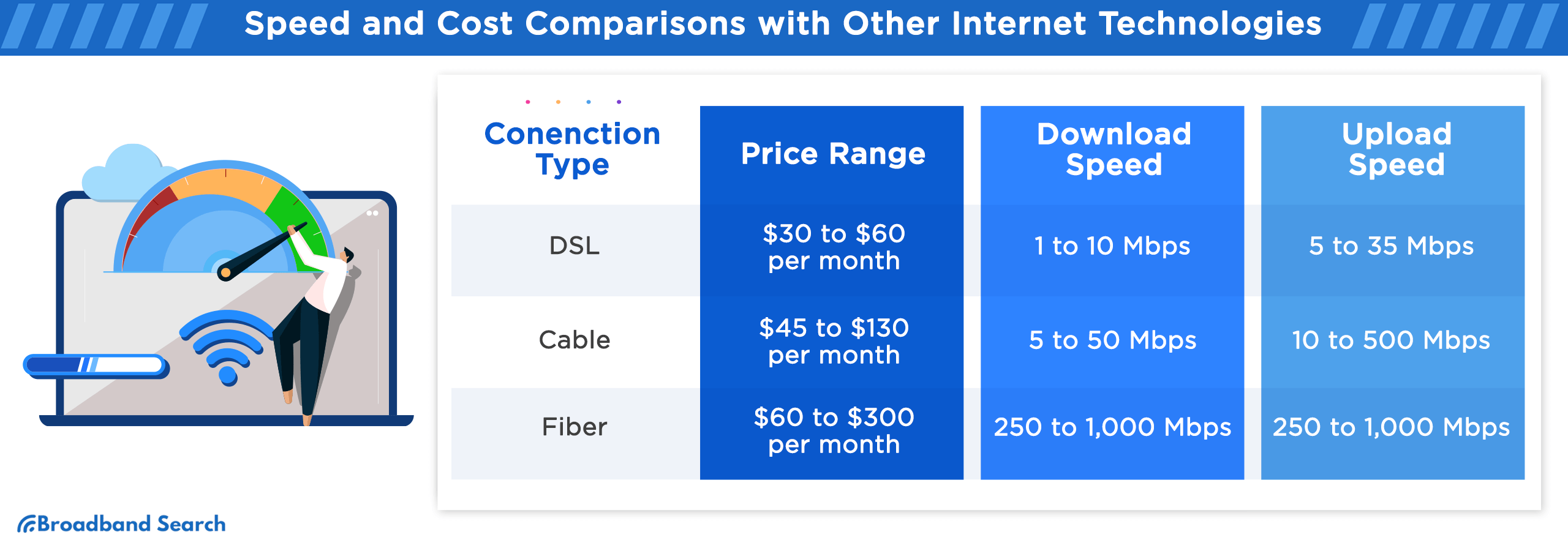

When evaluating different Internet technologies, it's crucial to consider key factors like cost, speed, and availability. Cable internet, in particular, falls between DSL and fiber options, offering a balanced choice for many users.

Cost

With its competitive pricing, Cable Internet provides an affordable option compared to fiber. Many cable providers offer bundled services, including TV and home phone, which can further reduce costs. It's important to note that cable internet often begins with a lower introductory rate, but prices may rise after the initial promotional period.

Price Range

Forbes has shared the regular cost range for various internet services. It's important to remember that these prices can differ depending on where you live and the internet provider you choose:

- DSL: $30 to $60 per month

- Cable: $45 to $130 per month

- Fiber: $60 to $300 per month

Speed and Performance

Cable internet boasts faster speeds than DSL, making it suitable for households with moderate to heavy internet use. While not as fast as fiber, some cable providers like Spectrum offer plans that come close to fiber speeds, making it a compelling choice for users seeking a balance between affordability and performance.

Fiber internet sets itself apart with symmetrical upload and download speeds, surpassing both DSL and cable in this regard. Cable internet, on the other hand, provides a reliable and consistent connection, making it a dependable choice for users who prioritize stability over lightning-fast speeds. It's readily available in urban areas like Dallas.

Speed Comparison (Mbps)

According to Forbes' latest data, these are the typical speed ranges for different internet services. Keep in mind that actual speeds may vary based on your location and service provider:

DSL Internet:

- Download speed range: 1 to 10 Mbps

- Upload speed range: 5 to 35 Mbps

Cable Internet:

- Download speed range: 5 to 50 Mbps

- Upload speed range: 10 to 500 Mbps

Fiber Internet:

- Download speed range: 250 to 1,000 Mbps

- Upload speed range: 250 to 1,000 Mbps

Peak Hour Speeds

Cable Internet is known for its fast and reliable service, widely available with generally good speeds. However, one significant drawback is that your internet speed can be impacted by the simultaneous usage of neighbors in your area, as the connection bandwidth is shared.

This shared network characteristic can result in speed reductions during peak hours, typically in the evenings from 4 PM to 10 PM when the highest number of users are online. This slowdown can affect activities such as streaming and gaming.

Cable Internet Connectivity Data and Demographic Insights in the US

Demographics of Cable Internet Users

Demographics of Cable Internet Users offer valuable insights into the preferences and choices of individuals and households regarding their internet connectivity. Although specific age and gender data are not readily available, we can still obtain important information from various sources:

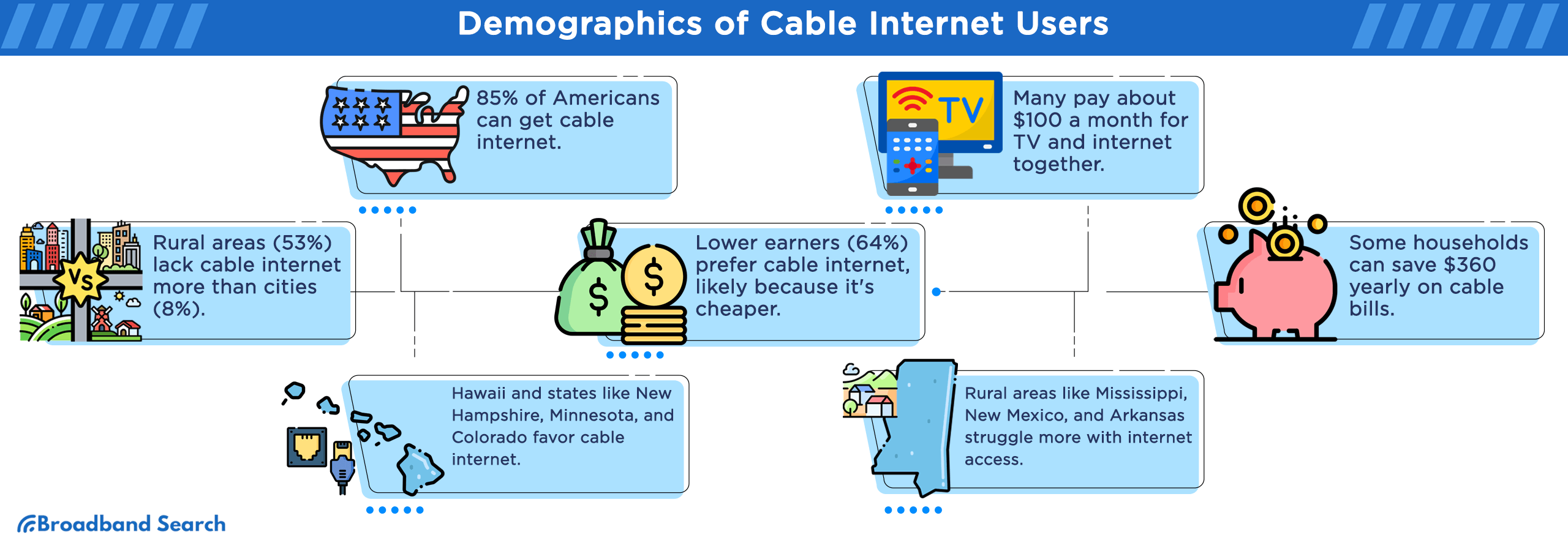

- Access to Cable Broadband: Recent statistics indicate that a substantial 85% of Americans have access to cable broadband. This widespread availability underscores cable internet's position as a common and accessible choice for a significant portion of the population.

- Bundled Services: Approximately 90 million U.S. subscribers continue to pay around $100 a month for traditional pay-TV services. Interestingly, many Americans retain these TV subscriptions because they are bundled with their internet service. For 56% of subscribers, bundling remains a primary reason for keeping their TV subscription. This bundling strategy often presents an attractive overall price for consumers, making it an influential factor in their decisions.

- Urban vs. Rural Divide: There is a significant urban-rural divide in cable internet access. According to the FCC, 53% of rural Americans lack access to home cable broadband, while only 8% of urban Americans face a similar limitation. This substantial 45 percentage point difference underscores the disparities in internet access between urban and rural communities.

- Income Levels: The choice of cable internet is significantly influenced by income levels. Remarkably, 64% of households earning less than $30,000 per year predominantly rely on cable networks for their internet service. This finding suggests that cable internet is often the preferred choice for lower-income households, likely due to its affordability and availability.

- Household Savings: On average, American households allocate approximately $1,122 annually toward cable and internet services. However, it's worth noting that qualifying households can benefit from up to $360 per year in assistance to offset their cable bills. This substantial assistance results in a remarkable 32% reduction in costs for the typical household cable bill, making it a significant financial relief for many families.

Geographic Distribution

Cable internet usage in the United States exhibits varying patterns across different regions and states.

In the state of Hawaii, cable internet is the most widely adopted type of internet connection. Similarly, states like New Hampshire, Minnesota, and Colorado also favor cable and DSL as their primary broadband options.

Interestingly, the divide between urban and rural areas plays a significant role in these variations. States with a more rural character, such as Mississippi, New Mexico, and Arkansas, tend to have a higher proportion of households without internet access. This disparity highlights the challenges faced by less densely populated regions in terms of internet availability and adoption.

Availability and Accessibility

Efforts to expand cable internet access in underserved regions are ongoing. Various government initiatives and private-sector investments aim to improve accessibility. The FCC's Universal Service Fund, for instance, supports initiatives like the Rural Digital Opportunity Fund, which allocates up to 20 billion dollars to bring high-speed broadband to underserved areas. These efforts seek to reduce the connectivity gap and ensure that all Americans have access to reliable internet services.

Cable Internet Infrastructure Investment Trends

- DOCSIS Upgrades: Cable operators are making substantial investments in upgrading their networks using DOCSIS technology. This "10G" service has undergone extensive testing in labs and field trials. As compatible equipment like amplifiers and modems became available, cable providers have been able to deploy symmetrical Gigabit-grade service. This investment allows cable internet to compete with symmetrical fiber-to-the-home (FTTH) services, offering higher speeds and pricing options to meet evolving consumer needs.

- Competing with Fiber: Cable operators recognize the importance of staying competitive with fiber-optic networks. By investing in these upgrades, they ensure that cable internet remains a viable and attractive option for consumers. This strategy not only enhances the quality of service but also provides a pathway for further advancements in speed and pricing, ultimately benefiting cable internet users.

Cable Internet Market Share in the US

Market Share Landscape

Recent consumer surveys indicate shifts in market share trends in the US broadband industry. Fiber broadband (FTTH) is on the rise, while cable modem (DOCSIS) share is decreasing. The category labeled as "Other" (primarily including fixed wireless and mobile-only households) has seen growth, likely due to the emergence of 5G technology. Currently, cable internet maintains the largest market share, holding approximately 47%.

In substantial revenue, research data indicates that cable broadband has generated surpassing $76.60 billion in 2022. This revenue growth has consistently outpaced the broader economy (GDP) in recent years, except for the previous year when fixed wireless services began attracting customers away.

In 2022, a Pew survey revealed that fiber internet services accounted for approximately 20% of the internet service market share in the United States. In contrast, cable internet services maintained a majority share, standing at just above 50%.

Leading Cable Internet Provider in the US

Comcast is the largest cable TV and home internet service provider in the United States. As of 2020, Comcast had around 19.7% of the pay-TV market and approximately 25.2% of the broadband internet market in the United States.

Top Cable Internet Providers

Among the numerous cable internet providers nationwide, it's important to know who stands out. Let's take a closer look at the top cable internet providers, highlighting their key features, pricing, and speeds.

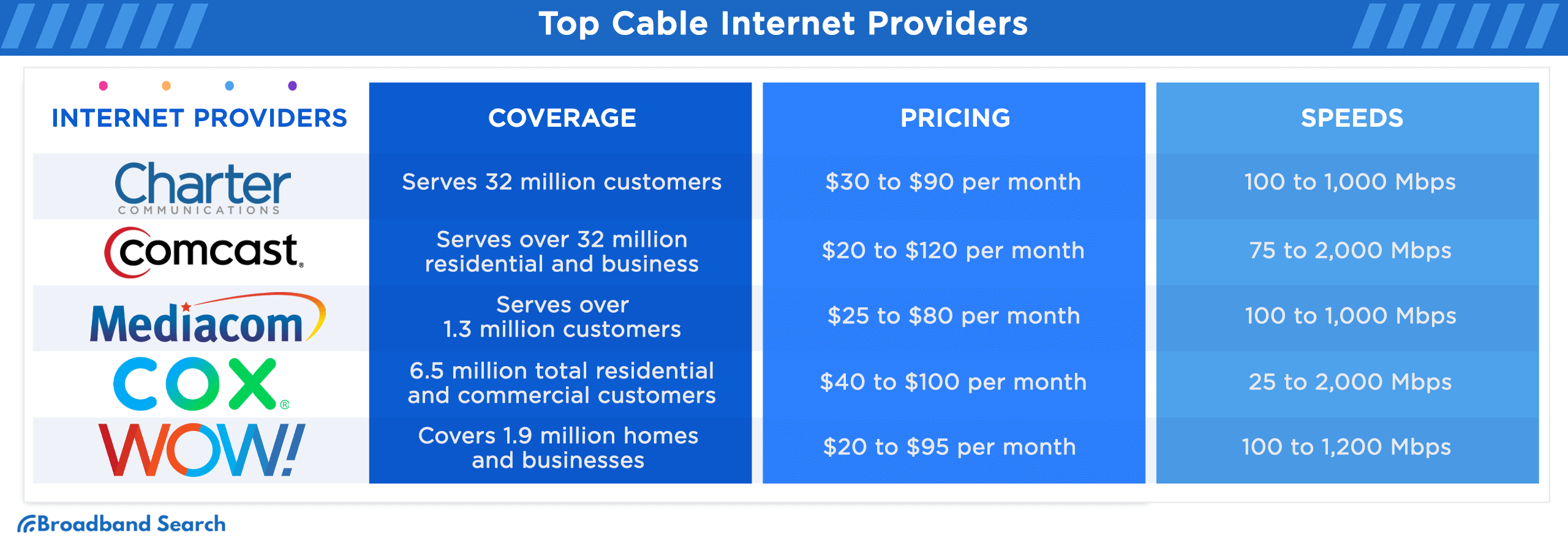

1.Charter Spectrum

- Coverage: Available in 41 states, serving over 32 million customers through its Spectrum brand.

- Pricing: Plans range from $30 to $90 per month.

- Speeds: Offers internet speeds from 100 to 1,000Mbps.

- Additional Info: No data limits, straightforward pricing, no long-term contracts, modem included, and access to free nationwide Wi-Fi hotspots.

2.Comcast Xfinity

- Coverage: Serves over 32 million residential and business broadband customers.

- Pricing: Monthly plans range from $20 to $120.

- Speeds: Internet speeds vary from 75 to 2,000Mbps.

- Additional Info: Some plans have data limits, multiple plan options available, and generally positive customer satisfaction.

3.Mediacom Communications Corporation

- Coverage: Serves over 1.3 million customers, mainly in smaller markets in the Midwest and Southeast.

- Pricing: Monthly plans range from $25 to $80.

- Speeds: Offers internet speeds from 100 to 1,000Mbps.

- Additional Info: Provides up to 6TB of monthly data allowance, introductory rates, and no long-term contracts.

4.Cox Communications

- Coverage: Approximately 6.5 million total residential and commercial customers.

- Pricing: Monthly plans range from $40 to $100.

- Speeds: Internet speeds range from 25 to 2,000Mbps.

- Additional Info: Offers a 1.25TB monthly data allowance, various plan options, and a unique gaming add-on.

5.WideOpenWest (WOW!)

- Coverage: The network covers 1.9 million homes and businesses.

- Subscribers: Approximately 538,100 as of November 3, 2022.

- Pricing: Monthly plans range from $20 to $95.

- Speeds: Offers internet speeds from 100 to 1,200Mbps.

- Additional Info: Features attractive promotional prices, no long-term contracts, and unlimited data on select plans.

Consumer Behavior and Preferences

Consumer Preferences in Cable Internet Plans and Bundling

- Internet and Cable TV Bundles: A popular choice is bundling home internet service with cable TV. These packages include both internet access, typically specified by download speeds, and cable TV, along with all the necessary equipment. A lot of homeowners choose this bundle for its convenience and cost-effectiveness.

- Internet and Mobile Phone Bundles: Cable internet providers often offer mobile phone plans through MVNOs (Mobile Virtual Network Operators) like Spectrum Mobile, Xfinity Mobile, and Optimum Mobile. This option allows customers to bundle their cell phone plan with their internet service, streamlining their communication and internet needs in a single package.

Customer Satisfaction Ratings

Customer satisfaction ratings for cable internet providers vary, and among national ISPs with bicoastal service, AT&T leads the survey with a high satisfaction rating of 72. These ratings reflect how well providers meet their customers' expectations in terms of reliability, support, and pricing, impacting consumer choices and loyalty.

Impact of Streaming Services on Cable Internet Usage

Increased Data Consumption:

Streaming services, such as Netflix, Amazon Prime Video, and Disney+, have led to increased data consumption. On average, streaming in HD quality consumes about 3 GB of data per hour. This trend has prompted many users to subscribe to higher-speed cable internet plans with larger data allowances.

Shift in Viewing Habits:

- Cost Savings: Traditionally paid television subscriptions can be expensive, exceeding $1,000 per year. To reduce costs, many people have turned to cable internet services, which are often more affordable. With lower cable expenses, consumers have been inclined to embrace streaming services, which offer content at a lower fee.

- Cable Network Challenges: Cable networks in the U.S. have faced challenges in the past decade, including declining subscribers. This has resulted in decreased television ratings and, consequently, reduced advertising revenue for these networks.

- Streaming Popularity: People who have cable TV and access to a range of cable channels are increasingly turning to online streaming as a supplement. Most respondents in a survey had online streaming subscriptions alongside their cable packages. Notably, many individuals are embracing multiple streaming packages. About 25% of survey participants with cable reported having two or more online streaming subscriptions, while for those without cable, the figure was slightly higher at 28%.

Changing Landscape of Household Spending

The way Americans spend their money on cable and internet services has shifted due to the rise of streaming services. According to research about the U.S. Cable & Internet Market Size and Household Spending Report for 2022, U.S. households now spend an average of $1,368 per year on cable and internet bills. This reflects a slight decrease from the previous year's average of $1,122 per year when considering all households.

In 2022, despite overall economic inflation, this research indicates that Americans collectively allocate $146 billion annually to cable and internet expenses. About 82% of U.S. households pay an average of $114 per month for these services. This shift in consumer spending habits signifies a small reduction from the 2021 analysis, which reported an average monthly expenditure of $116.

Challenges in Cable Broadband Growth: An Industry in Transition

The cable broadband industry is witnessing a transformation, with shifts in subscriber numbers and emerging trends reshaping its landscape.

Subscriber Losses

The three largest U.S. cable companies recently reported residential broadband subscriber losses. Comcast Corp. managed to maintain zero net additions when business customers were considered, but Charter Communications Inc. suffered a loss of 21,000 broadband customers, its first second-quarter decline since 2013. Altice USA Inc. also faced challenges, losing approximately 39,600 residential broadband customers for the fourth consecutive quarter.

Historically, the cable industry experienced seasonality in subscriber numbers, particularly as college students often disconnected subscriptions at the end of the school year. However, this year's figures also reflect new trends tied to home buying patterns, government subsidy reductions, and the emergence of fixed wireless competition.

Impact of Fiber and Fixed Wireless

Cable Broadband's subscriber growth is facing pressure due to competition from fiber and fixed wireless broadband providers. While cable TV subscriptions have been on the decline, the cable industry has tried to compensate by increasing its focus on internet subscriptions.

Technological Advancements

Future Technological Developments

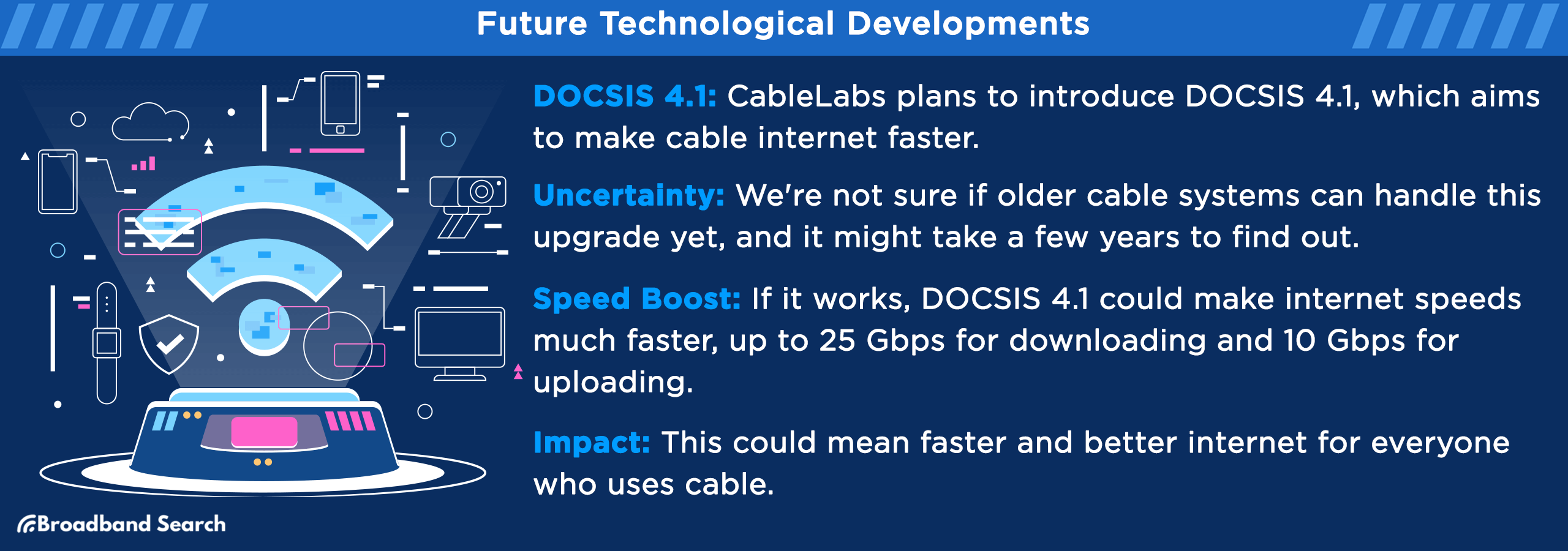

CableLabs is already planning the next leap in cable internet technology with DOCSIS 4.1. This advancement aims to extend the DOCSIS spectrum up to an impressive 3 GHz, representing a substantial upgrade in usable spectrum. While the technical feasibility of this upgrade on aging cable systems from the 1990s remains uncertain and may take a few years to confirm, DOCSIS 4.1 holds the potential to become one of the final DOCSIS standards before cable systems contemplate transitioning to all-fiber networks.

CableLabs has a track record of maximizing network performance on the original coaxial copper cable infrastructure, initially designed for analog TV signal distribution. If DOCSIS 4.1 proves viable, it could support remarkable speeds of up to 25 Gbps downstream and 10 Gbps upstream. This future technological development could pave the way for even faster and more efficient cable internet services, keeping pace with the evolving demands of users and applications.

Fiber Integration

Hybrid cable drops technology represents a significant advancement in how we access the internet. By combining fiber-optic and copper cables, it brings together the best of both worlds—high-speed data transfer and power delivery.

Key Features and Advantages:

- Blazing Fast Internet Speeds: Fiber-optic cables, known for their speed and bandwidth, enable lightning-fast internet connections with minimal latency. Hybrid cable drops use this technology, ensuring swift and reliable data transfer for a seamless online experience.

- Power Transmission: Unlike traditional Ethernet cable drops that only handle data, hybrid cable drops can also transmit power. This eliminates the need for separate power cables, simplifying installations and reducing clutter.

- Versatility: Hybrid cable drops are compatible with existing Ethernet infrastructure, making it easy to adopt this technology without a complete overhaul. Organizations can leverage their current networking setups while benefiting from enhanced performance and power delivery.

Implications of 5G on Hybrid Cable:

The emergence of 5G networks presents various opportunities and challenges for hybrid cable drop technology. As 5G networks offer unprecedented speeds, the need for reliable high-speed connectivity within buildings becomes critical. Hybrid cable drops bridge the gap between high-speed 5G networks and internal infrastructure, which ensures efficient data transfer and power delivery. This integration enables seamless connectivity for personal and industrial use cases, addressing the demands of the 5G era.

Final Point

With the majority of Americans having access to Cable Internet, it's clear that this digital connection has become an integral part of our daily lives. We've seen how it grew from a simple television cable to being bundled with the internet, a preference for most Americans, and how it evolved from a basic concept to a high-speed necessity, connecting us in countless ways.

But the story doesn't end here. The future of Cable Internet holds exciting possibilities, like the upcoming DOCSIS 4.1 technology. Think of it as the next generation of fast and reliable internet. With DOCSIS 4.1, we can expect even faster speeds, making downloads a breeze and online activities smoother.

So, as we navigate this digital landscape, let's remember that the Cable Internet saga is far from over. It's a journey filled with discoveries and innovations, and we're all part of it. Keep exploring, keep enjoying the connections that Cable Internet brings to our lives, and stay tuned for what the future holds.

FAQ

What is cable internet, and how does it work?

Cable internet is a high-speed internet service delivered through a cable modem and coaxial cable. It operates over the same infrastructure as cable television and provides internet access by transmitting data over the cable network.

What are the advantages of cable internet?

Cable internet provides high-speed access, making it suitable for activities like online gaming, streaming HD videos, and large file downloads. It's often bundled with TV services, making it convenient for households.

Are there any disadvantages or limitations to cable internet?

One limitation of cable internet is that speeds can decrease during peak usage times when many people in the same area are online. Additionally, its availability can vary by location, with some rural areas having limited access.

How can I check if cable internet is available in my area, and what speeds can I expect?

You can check the availability of cable internet in your area by contacting local cable providers or using online tools provided by ISPs. Speeds can vary depending on your location and the specific plan you choose, but many cable internet plans offer speeds ranging from 100 Mbps to 1 Gbps or more.

How fast is cable internet compared to other types of internet service?

Cable internet has made significant speed improvements, offering an average download speed of around 10 - 500 Mbps and an average upload speed of approximately 5 -50 Mbps and, with DOCSIS 4.0, reaching up to 10 Gbps. It competes with fiber-optic services and can be as fast or faster than DSL.